Case Study: Frontline Financing

Speeding up loan approvals

The challenge

Frontline is a financing platform developed by LendCare. It empowers merchants to offer their own seamless financing solutions.

By providing merchants with a self-serve online application process, Frontline aimed to revolutionize the financing experience for both merchants and their customers.

The ask for our digital team was to create a digital process for applying for, managing and submitting financial loan applications.

The traditional financing processes for merchants often involve lengthy paperwork, manual approval processes, and limited flexibility. Frontline identified the need for a solution that enables merchants to provide financing options quickly and efficiently, enhancing customer satisfaction and driving sales.

Once the application was completed by the customer or merchant, it would then be automatically submitted for approval. The portal would allow the customer or merchant to easily access all applications in the system, eliminating the need for printing and manually archiving all the applications.

Impact

Frontline is a financing platform developed by LendCare. It empowers merchants to offer their own seamless financing solutions.

By providing merchants with a self-serve online application process, Frontline aimed to revolutionize the financing experience for both merchants and their customers.

The ask for our digital team was to create a digital process for applying for, managing and submitting financial loan applications.

The traditional financing processes for merchants often involve lengthy paperwork, manual approval processes, and limited flexibility. Frontline identified the need for a solution that enables merchants to provide financing options quickly and efficiently, enhancing customer satisfaction and driving sales.

Once the application was completed by the customer or merchant, it would then be automatically submitted for approval. The portal would allow the customer or merchant to easily access all applications in the system, eliminating the need for printing and manually archiving all the applications.

Key pain points

Customers had to manually fill out and apply for financing and wait for unacceptable lengths of time for response for approval or denial. This was a really aged process which was both a time consuming and painful process.

Merchants had to store and manage physical paper documents that could get easily lost, damaged or filled out incorrectly causing further delays

Customers had to fill out in person or download and print a PDF form which they then filled out by hand, scanned and emailed to the merchant. This was a really time consuming and painful process.

Since the form displayed all possible information for both merchant and customer loan requests, customers were overwhelmed with the options

A lot of the times customers didn’t have all the information so they’d need to contact their spouse and ask for help

The merchant who received the complete (or incomplete form) would then have to manually validate it and contact the customer if there was anything missing or incorrectly filled out

Key strategies

Create a digital intake form in place of paper PDF forms, include responsive mobile design

Reduce call centre calls by highlighting incorrect/missing information during the application process

Streamline the form process by only showing relevant content depending on the stage in the process

Redesign the information architecture and display information in digestible chunks, reducing customer anxiety instead of increasing it by displaying the entire form all at once

Utilize progressive disclosure so if a customer is missing a key piece of information, they cannot progress in the flow and don’t waste time filling out the entire form

Skills

Stakeholder interviews

UI design (Bryan McCloskey)

Design reviews and iteration

Prototyping & interaction design

User acceptance testing

Users

Merchants and their clients

Team members

Product Owner (Detour UX)

UX Design (Nick Bollen)

Periscope (Development)

QA

Part 1 - Applicant Portal

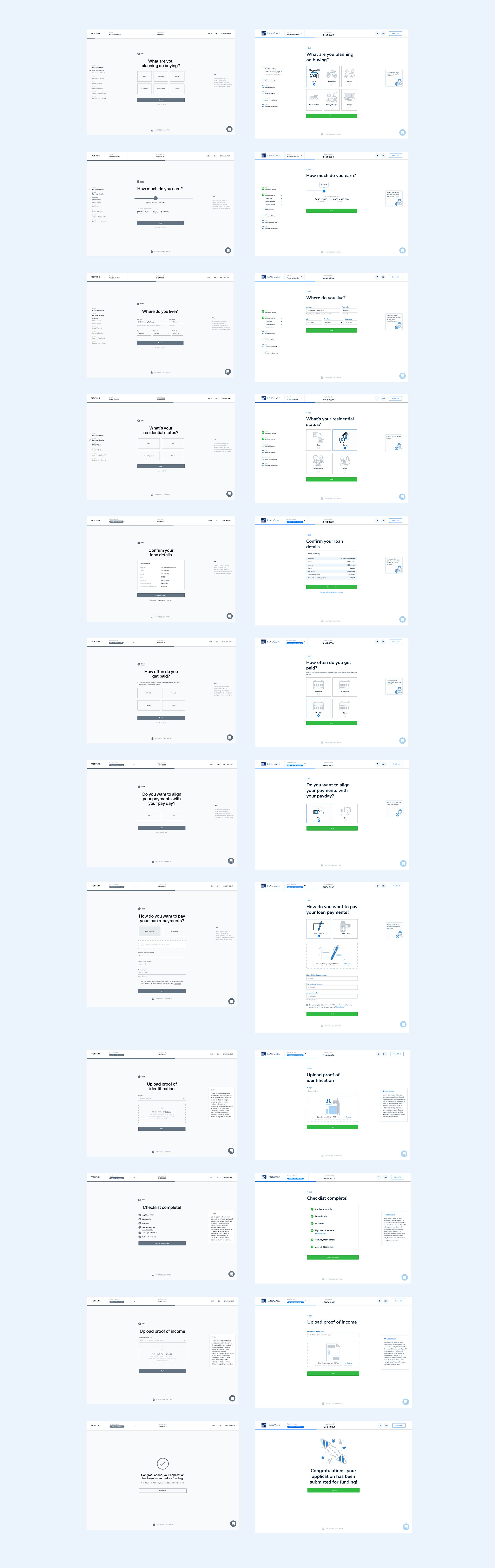

Below are a mix of desktop and mobile screens showing the UI

The applicant portal was a DIY application experience. Applicants would apply for financing through either the merchant's site, or from a link sent by the sales staff.

Notice how each step is broken down into bite-sized chunks of either information or user tasks.

We kept the main content centred on screen, flanked by a progress tracker on the left and support help on the right. This allowed for greater focus and concentration on the part of the user.

Above shows the wireframes and high fidelity screens

Research

User Interviews: Engaged with merchants to understand pain points and challenges in offering financing options to customers.

Market Analysis: Studied existing financing platforms and solutions to identify areas for improvement and innovation.

Competitor Analysis: Analyzed competitor offerings to identify gaps and opportunities for differentiation in the market.

Design Process

User Persona Development: Created user personas representing merchants of varying sizes and industries to understand their needs, preferences, and pain points.

Wireframing and Prototyping: Developed wireframes and prototypes of the Frontline platform, focusing on intuitive user interfaces, streamlined application processes, and self-service capabilities.

User Testing: Conducted usability testing sessions with merchants to gather feedback on the platform's design, functionality, and user experience.

Iterative Design: Incorporated user feedback to refine the platform's interface, improve usability, and address pain points identified during testing.

Solution

Frontline offers a user-friendly platform that enables merchants to provide financing options to their customers quickly and easily:

Self-Serve Application Process: Merchants can access the Frontline platform to initiate and manage financing applications for their customers entirely online.

Customizable Financing Programs: Frontline allows merchants to customize financing programs based on their specific needs, including interest rates, payment terms, and eligibility criteria.

Instant Approval: With Frontline, merchants can offer customers instant approval for financing applications, reducing friction and improving the purchasing experience.

Integration Capabilities: Frontline integrates seamlessly with merchants' existing systems and processes, providing a cohesive and efficient financing solution.

Outcome

Increased Sales: The Frontline platform has enabled merchants to offer financing options to their customers more effectively, leading to increased sales and revenue.

Improved Customer Experience: By streamlining the financing application process and offering instant approval, Frontline has enhanced the overall purchasing experience for customers.

Greater Efficiency: The self-serve nature of the Frontline platform has reduced administrative burden for merchants, allowing them to focus on growing their businesses.

Positive Merchant Feedback: Merchants have praised Frontline for its ease of use, flexibility, and impact on their bottom line.

Part 2 - Merchant Portal

The Merchant Portal segment of the application empowers sales representatives and merchants with comprehensive management capabilities to manage, update and edit customer applications.

Merchants can facilitate the entire application process on behalf of their customers, distribute application links directly to customers, monitor the status of ongoing applications, and access detailed reporting functionalities.

Managing the Applicant vs Merchant Portals

It was certainly challenging to balance the design of both sides of the product from a UI perspective. They needed to look vastly different yet similar 🧐. The Merchant Portal obviously had much more information to display and was thea more robust portion of the app while the Applicant Portal was simple and minimalistic with a heavy focus on ease of use. We knew that a wide variety of users would be engaging with the product so (Nick Bollen) conducted diligent user testing sessions to ensure we delivered.

Future considerations

Continued refinement and optimization of the Frontline platform based on merchant feedback and emerging trends in the financing industry. Additionally, ongoing collaboration with merchants to identify new features and enhancements that further meet their needs and drive business growth.

Conclusion

By providing merchants with a user-friendly and customizable financing platform, Frontline has empowered businesses to offer financing options to their customers seamlessly. With its focus on simplicity, flexibility, and efficiency, Frontline is poised to continue driving growth and innovation in the merchant financing space.

Next steps

This product ultimately became goeasy Connect